Bookkeeping is the backbone of every successful business. It ensures accurate financial records, tax compliance, and smart decision-making. However, many companies, especially smaller ones, struggle with common bookkeeping mistakes. With the proper information, companies can easily avoid these mistakes.

In fact, 82% of small businesses fail due to cash flow problems, often caused by poor bookkeeping practices.

Source: Regpack

Failing to track expenses properly and not reconciling accounts can cost businesses time, money, and growth opportunities. So, let’s explore which mistakes you should not be making.

5 Common Bookkeeping Mistakes Businesses Make

Here are five common bookkeeping mistakes businesses must avoid:

1. Failing to Track Expenses Properly

Source: OnPay

For businesses to succeed, they need to keep track of their business expenses, and this is where most of them make mistakes. Neglecting this can lead to missed tax deductions, cash flow problems, and compliance issues. Let’s break down the two common mistakes businesses are making in this domain:

Not Keeping Receipts and Documentation

Without proper documentation, businesses risk overlooking deductible expenses, which can result in higher tax liabilities. Untracked expenses can also lead to inaccurate financial statements.

Imagine you’re at a café discussing a project with a client. You pay for the coffee but toss the receipt, thinking it’s a minor expense. Over time, these small and untracked expenses add up. And without receipts, you can’t claim them as deductions during tax season.

Mixing Personal and Business Expenses

Using the same bank account for personal and business transactions might seem convenient, but it creates a tangled mess. So, if you want your business to flourish, separate personal and business expenses.

For example, if you buy office supplies and groceries with the same credit card, distinguishing between deductible business expenses and personal ones becomes challenging. This simple-looking mix-up can lead to inaccurate financial records and complicate tax filings.

2. Incorrectly Categorizing Transactions

One of the most common bookkeeping mistakes businesses make is misclassifying transactions. It might seem like a minor mistake, but can cause significant financial reporting errors, tax miscalculations, and even cash flow problems over time. Here’s how it impacts a business:

The Impact of Misclassification

Mixing up transaction records can throw your finances into disarray. Simple errors—like recording a business expense as personal and categorizing a loan repayment as income—can lead to:

- Inaccurate Financial Statements: If your expenses are miscategorized, your profit and loss statement won’t reflect the accurate picture of your business.

- Tax Issues: The IRS uses your financial statements to determine your tax liability. If expenses aren’t correctly categorized, you might underpay or overpay taxes.

Studies show that over 60% of small business owners find bookkeeping overwhelming and struggle to keep their books in order.

Source: OBS Business

Relying Too Much on Automation Without Review

Many business owners assume that automation can handle everything perfectly. Though it saves time, it’s not foolproof. AI systems guess where a transaction belongs based on past entries, but can’t always differentiate between similar expenses.

Moreover, if a business owner uses multiple payment methods (credit card, PayPal, and bank transfers), automation tools might double-record transactions. It’s always better to hire a bookkeeper rather than filing fines for wrong tax returns.

3. Not Reconciling Accounts Regularly

The next common bookkeeping mistake is overlooking account reconciliation. Many businesses, especially small ones, fail to regularly compare their books with bank statements, credit card records, and other financial accounts. So, make sure you don’t skip this step, or you might get stuck in errors, fraud, or economic mismanagement.

The Risks of Skipping Reconciliation

Failing to reconcile accounts regularly can create serious financial issues. Here’s why:

- Undetected Errors: A vendor might charge you twice, a customer payment might not go through, or an automated software error could misrecord transactions.

- Fraud and Unauthorized Transactions: Regular reconciliation helps detect fraud early. If an employee, vendor, or outsider makes unauthorized transactions, catching them quickly prevents further losses.

- Inaccurate Financial Reports: If your accounts don’t match the accurate picture, you might overestimate profits, underestimate expenses, or miscalculate debt.

- Tax Filing Issues: Discrepancies in your accounts can create problems during tax season. You could overpay or underpay taxes if income or expenses aren’t recorded properly.

Consider using account reconciliation services (if your budget allows) to tackle this issue. It would prove invaluable in the long run.

4. Ignoring Tax Deadlines and Compliance Requirements

Many businesses make the mistake of not keeping up with tax deadlines and compliance requirements. Taxes might feel overwhelming, but missing deadlines can lead to penalties, interest charges, and even legal trouble.

Missing Tax Payments and Filings

Paying taxes on time isn’t just about avoiding fines—it’s about keeping your business in line with regulations. You might think a little fine wouldn’t dent your business, but here’s what you need to understand.

The IRS late payment penalty is 0.5% of the unpaid tax per month, and the late filing penalty is 5%, which can go up to 25% in both cases. In the beginning, it might not be significant, but over the months, it could add up and become a serious financial burden, which can be called in for an IRS tax audit.

On top of penalties, you’ll owe interest on overdue taxes, which accumulate daily. This means the longer you wait, the more you’ll owe.

5. Not Having a Backup and Disaster Recovery Plan

Even though financial data is one of a business’s most valuable assets, many fail to have a proper backup and disaster recovery plan in place.

It must be taken seriously because failing to back up financial records can lead to significant risks, including lost revenue, compliance issues, and business disruptions. Some of the biggest dangers in this space include:

Permanent Data Loss

Without proper backups, a single mistake can wipe out months or even years of financial records. Moreover, you’ll lose everything if you rely on one device or server to store all your financial data and it suddenly crashes.

Cybersecurity Threats

Cybercriminals target businesses through ransomware attacks, encrypting their financial data and demanding payment to restore access. If a hacker gains access to your accounting software, they could delete or manipulate transactions.

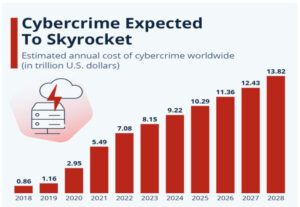

According to Statista, the cost of global cybercrime is steadily rising and could reach $13.82 trillion by 2028. You could be one of the victims.

Ensure you’re protected by investing in storage and recovery plans.

Source: Statista

Let SmoothBooks Save You From Common Bookkeeping Mistakes

Many business owners make common bookkeeping mistakes, such as misclassifying transactions, failing to reconcile accounts, or missing tax deadlines. These errors might seem unimportant initially, but they can quickly become significant and a financial burden.

So, what’s the best option that you’ve got here? A bookkeeping company.

Instead of spending hours balancing your books, why not let our professional bookkeepers handle it for you? At SmoothBooks, we do just that with cost-effective, reliable, and professional bookkeeping services.

Get in touch today by calling us at (877) 243-7426.