Financial audits mean a systematic review of a company’s financial records to ensure accuracy and compliance. While they may seem complicated and unnecessary at first, a properly conducted audit plays a key role in maintaining transparency and building trust with stakeholders.

Audits are also helpful in identifying potential errors, such as data entry, which alone accounts for nearly $600 billion in losses every year. And these are just a few of the benefits; there are numerous other advantages of conducting a regular financial audit.

Below, we’ll explore each of these benefits in detail and help you begin with the auditing process.

What Are Financial Audits?

In the simplest terms, financial audits of a business ensure that the financial records and statements are accurate, complete, and in compliance with relevant laws and regulations. Individuals who conduct the audits are called ‘auditors’; they create a detailed report and verify the accuracy of the company’s records.

If discrepancies are found, auditors will flag them and suggest necessary actions to align the financial statements with accounting standards and regulations.

Importance of Regular Financial Audits

Now that you understand the concept of financial audits, let’s explore why they’re essential and the benefits they bring to a business.

1. Compliance with Country Laws

Every country has specific laws regarding businesses’ financial practices, and audits are an integral part of these laws. In the USA, both private and public companies are encouraged to conduct regular financial audits.

For public companies, audits are mandatory as businesses are required to submit quarterly reports, known as 10-Qs. Private companies, on the other hand, aren’t legally bound to submit financial reports. Still, it’s highly recommended that they conduct an audit, especially if they plan to borrow money or attract investors.

Without regular audits, the public may lose interest in the company’s shares, and potential investors may hesitate to invest.

2. Fraud and Prevention

One of the key reasons for conducting audits is to identify and prevent fraud in a timely manner, and financial audits are highly effective in achieving this goal.

With financial audits, companies can easily find inconsistencies or actions in the records that don’t match their policies. Once the fraud is identified, high authorities can take immediate action to address the issue and create policies that minimize the chances of fraud in the future.

3. Transparency for Businesses and Investors

According to research, approximately 91.2% of businesses require financing as soon as possible. Without funding, many of the startups will likely fail. If you’re facing a similar situation and need investors or a loan, a financial audit is the first step.

Investors and banks both look for the details present in audits, as they provide a clear picture of the company’s financial health. This ensures that the business is capable of handling future financial commitments and risks. No audit reports means you’re leaving potential investors and lenders in the dark, making it harder to secure the support you need.

4. Detecting Errors and Misstatements

Another reason for conducting a financial audit is to detect errors and misstatements. On average, these mistakes cost U.S. businesses $7.8 billion each year, which is a significant amount. You can avoid these costly errors by conducting regular financial audits at least once or twice a year.

Besides this, hire a virtual bookkeeper to maintain your financial records and further reduce the risk of errors.

5. Comply with Contractual Requirements

Companies often enter into contracts with various organizations, lenders, and investors. These agreements typically include clauses that both parties must follow, such as maintaining up-to-date financial records, submitting periodic reports, or conducting regular audits.

If these contractual requirements are not fully met, the other party may consider it a breach of contract, potentially resulting in legal action or penalties. This often comes with significant financial and reputational risks for your business.

6. Improved Decision-Making

Regular financial audits are extremely helpful for informed decision-making. With a comprehensive audit report, your team can easily identify any financial weaknesses and areas that need improvement. This insight allows for more strategic planning and smarter resource allocation.

7. Strengthening Business Reputation

Beyond profits and customers, market reputation is one of its most valuable assets. The stronger your reputation, the more trust you build with clients, investors, and stakeholders, and regular audits play a key role in achieving that trust. They show your commitment to transparency, accountability, and sound financial practices.

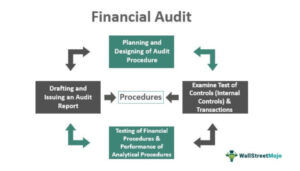

Prepare for the Financial Audits: Step-by-Step Process

If you’ve decided to proceed with the financial audits after exploring the benefits, here’s what you need to do next. The steps outlined below will guide you through the process and help you prepare for it.

Step #1: Update Your Books

Start by updating your books and making sure all financial records are accurate and up-to-date. If you’re unsure how to proceed, don’t worry—we can help. At Smoothbooks, our virtual bookkeepers ensure your business is audit-ready, whether it’s for tax season or any other financial review.

Step #2: Collect All Documents

Once your books are in order, collect all essential documents. This includes tax returns, financial statements, accounting records, IRS documents, and any other relevant paperwork. Preparing these in advance saves you from scrambling at the last minute.

Step #3: Inform All Stakeholders

In the last, communicate with all stakeholders, including employees, investors, and your management team, that a financial audit is underway. Their cooperation and timely input can significantly streamline the audit process.

Smoothbooks for Financial Reporting & Professional Bookkeeping

Regular financial audits aren’t just about ticking boxes—they’re essential for protecting your business. Without them, inefficiencies, fraud, and financial errors can go unnoticed, putting your company at serious risk.

If you’re unsure where to turn for expert and affordable bookkeeping services, we’ve got you covered.

Our team of dedicated remote bookkeepers will help you manage your finances, prepare for audits and ensure full compliance. We can assist you with data entry, bookkeeping, write-ups, financial reporting, cost accounting, sales tax calculation, and many other financial tasks to keep your business running smoothly.