Are you a new business owner looking for a way to keep your books in order? You’re in the right place. Studies show that 40% of businesses don’t like bookkeeping and call it the worst part of their job.

Without proper bookkeeping, businesses risk cash flow issues, tax problems, and financial confusion—which can lead to costly mistakes. But don’t worry!

Here’s a guide on bookkeeping for beginners so you know exactly what you need to do to succeed.

Understanding Basic Bookkeeping for Beginners

Bookkeeping is the foundation of every successful business. It’s the process of recording, organizing, and managing financial transactions so that a business always has a clear picture of its financial health.

In simple words, bookkeeping is about tracking money coming in and going out of a business. This includes:

- Income (Revenue): Money earned from selling products or services.

- Expenses: Costs like rent, utilities, supplies, and payroll.

- Assets: What your business owns, like equipment, inventory, and cash.

- Liabilities: Debts or obligations, such as loans or unpaid bills.

Why is Bookkeeping Important?

Many beginners underestimate the importance of bookkeeping, but keeping your books in order has several benefits:

- Tracks Cash Flow: Helps ensure you have enough money to cover expenses.

- Simplifies Tax Filing: Well-organized records make it easy to report income and deductions.

- Improves Financial Decision-Making: Clear financial data helps businesses budget and plan for growth.

- Prevents Costly Mistakes: Errors in financial tracking can lead to penalties, missed payments, or even legal issues.

Four Types of Bookkeeping Systems

There are different bookkeeping systems available, depending on business size, complexity, and accounting needs. A few of them are:

1. Single-Entry Bookkeeping System

This type of bookkeeping system is best for small businesses, freelancers, and sole proprietors. In its simplest form, businesses track transactions like sales and business expenses in a basic spreadsheet.

2. Double-Entry Bookkeeping System

This system is best for medium to large businesses and companies that need accurate financial tracking. It ensures that every debit entry has a corresponding credit entry and provides a detailed financial overview.

3. Cash-Based Bookkeeping System

The cash-based bookkeeping system is best for small businesses, startups, and businesses with simple financial transactions. It is straightforward because it focuses only on actual cash flow—it does not track unpaid invoices or bills.

4. Accrual-Based Bookkeeping System

An accrual-based bookkeeping system is Ideal for medium to large businesses that offer credit terms. This system follows the matching principle, meaning revenue and expenses are recorded when they are earned or incurred, not when cash is exchanged.

Setting Up Your Bookkeeping System

Around 64% of business owners love to handle their books on their own, and if you’re one of them, here’s how you can set up your bookkeeping system:

1. Choosing the Right Bookkeeping Method

First, you need to decide which bookkeeping method best suits your business needs. The two primary ones are single-entry bookkeeping and double-entry bookkeeping. Choose the one that best suits your business size and requirements.

2. Selecting Bookkeeping Software or Service

Most businesses now use accounting software instead of manually recording transactions. Some of the most famous ones include QuickBooks and Xero. By choosing the right one, you can easily save yourself from unnecessary errors and automate your tasks.

Statistics show that almost two-thirds of business owners use accounting software to help their businesses grow.

You can also hire an affordable bookkeeping service to handle everything for your business. It’s highly recommended, as professional help can ensure accuracy and free up your time to focus on growing your business.

3. Setting Up a Chart of Accounts

A Chart of Accounts (COA) is the backbone of your bookkeeping system. It organizes your financial transactions into different categories, allowing you to easily track income, expenses, assets, liabilities, and equity.

To set up your COA:

- Start with broad categories (Assets, Liabilities, Revenue, Expenses, etc.).

- Break each category into specific accounts (e.g., “Office Supplies” under Expenses).

- Assign numbers to accounts for easy tracking and organization.

Recording Financial Transactions

Every sale, expense, invoice, or payment must be documented properly to ensure a clear financial picture of your business. Most businesses fail due to poor cash flow management, so try not to make the same mistakes as the others. Here’s how you can efficiently record your financial transactions:

1. Tracking Income and Expenses

Every dollar earned or spent should be categorized appropriately and recorded to create an accurate profit and loss statement (P&L).

Revenue refers to the money earned from sales, services, or other business activities. Some sources of income include:

- Sales revenue

- Service fees

- Rental income

- Interest earned

- Investment returns

On the other hand, business expenses include all costs required to operate a business, such as rent, salaries, and utilities. It includes:

- Rent and utilities

- Payroll and contractor payments

- Office Supplies

- Marketing and advertising

- Loan repayments

2. Managing Accounts Payable and Receivable

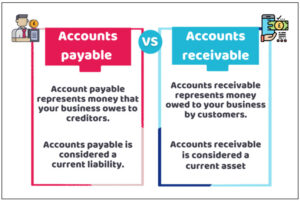

Account payable refers to money your business owes to suppliers, vendors, or service providers. Some accounts payable include outstanding supplier invoices, loan payments, etc. You can set up automatic payments to track it to reduce the risk of missing due dates. Also, negotiate with vendors on longer payment terms to improve cash flow.

Meanwhile, account receivable refers to money owed to your business by clients or customers. These include unpaid customer invoices, subscription payments, etc. To manage it, you can use automated reminders for unpaid invoices and offer multiple payment options to speed up transactions.

3. Reconciling Transactions with Bank Statements

Bank reconciliation is the process of matching your financial records with your bank statements to ensure accuracy. By using this method, you can:

- Detects errors: Catches duplicate entries or incorrect transaction amounts.

- Prevents fraud: Identifies unauthorized or fraudulent withdrawals.

- Ensures accurate financial reports: Helps avoid discrepancies before tax filing.

If you have the budget to handle everything yourself, you can also get account reconciliation services from a bookkeeping firm.

Bookkeeping and Taxes

One of the most important aspects of bookkeeping is ensuring that your business stays compliant with tax regulations. Poor record-keeping can lead to missed deductions, tax penalties, or even IRS tax audits.

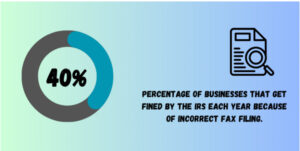

Studies show that the IRS fined 40% of small businesses each year because of incorrect tax filings. So, try to be in the other 60 percent.

Key taxes that businesses need to track are:

- Income Tax: Paid on profits earned by your business. Sole proprietors and LLCs report this on their tax returns, while corporations file separately.

- Self-Employment Tax: If you’re self-employed, you must pay Social Security and Medicare taxes (around 15.3% of net earnings).

- Sales Tax: If you sell goods or services, you may need to collect and remit sales tax based on state or local regulations.

- Payroll Taxes: Businesses with employees must withhold and submit payroll taxes (income tax, Social Security, and Medicare).

Let SmoothBooks Be Your Virtual Bookkeeper

Bookkeeping for beginners can feel overwhelming, especially when you’re juggling multiple tasks to keep your business running. But it doesn’t have to be like that because we’re here to help.

At SmoothBooks, we take the hassle out of bookkeeping by offering expert virtual bookkeeping services that keep your finances organized, accurate, and stress-free.

Starting at only $400 per month, let us handle your bookkeeping while you focus on growing your business.