For many business owners, bookkeeping becomes overwhelming, time-consuming, and stressful. If you’re one of them who is struggling to keep up with financial records, missing tax deadlines, or feeling unsure about your numbers, it might be time to outsource your bookkeeping.

Hiring a professional bookkeeper can help you stay organized, avoid costly mistakes, and gain financial clarity. But how do you know when it’s the right time to outsource? Let’s find out.

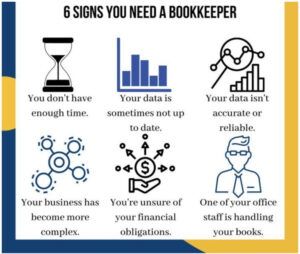

Five Clear Signs Your Business Needs a Bookkeeper

If you’re unsure whether it’s time to outsource bookkeeping, here are some clear signs that your business needs a professional bookkeeper.

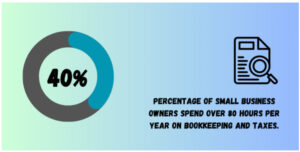

1. You’re Spending Too Much Time on Bookkeeping

As a business owner, your time is valuable. If you’re spending hours managing books instead of focusing on business growth, you might be losing money in the long run.

A study found that 40% of small business owners spend over 80 hours per year on bookkeeping and taxes—time that could be used to grow their business.

Example: If you’re a restaurant owner, your priority should be customer service, marketing, and operations, not manually recording every food purchase and supplier invoice.

2. Your Books Are Disorganized or Inaccurate

If your financial records are messy, you risk making costly mistakes that could hurt your business. Some signs of disorganized books include:

- Receipts and invoices are scattered everywhere.

- Unreconciled bank statements lead to missing transactions.

- Financial statements that don’t match your actual cash flow.

- Difficulty tracking who owes you money and what bills are due.

Example: Suppose you’re a freelancer managing multiple clients. Because of this, you keep missing invoices and fail to track payments. These little mistakes can become major issues in the long run.

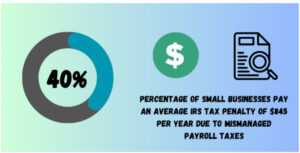

3. You’re Missing Tax Deadlines or Facing Penalties

Failing to keep up with tax filings can lead to penalties, interest fees, and even legal trouble. So, if you’re scrambling during the tax season, it’s time to hire a virtual bookkeeper–-you can probably afford one, considering the high workflow.

Some common tax issues that might be arising include:

- Late tax filings lead to penalties.

- Underreporting income or missing deductions.

- Errors in payroll tax calculations.

A report shows that 40% of small businesses pay an average IRS tax penalty of $845 per year due to mismanaged payroll taxes. To tackle this, it’s best to get payroll management services from a bookkeeper or a firm to save yourself from such penalties.

4. You Don’t Have Clear Financial Insights

A business needs detailed financial reports, or it becomes difficult to succeed. Without a Profit and Loss Statement, Cash Flow Statement, or Balance Sheet, you might not even know if your business is profitable.

Some red flags to keep an eye out for:

- Don’t know your monthly revenue vs. business expenses.

- Unsure if you can afford to hire new employees or expand.

- Haven’t made any reports to present to investors or lenders.

Studies show that businesses that track financial reports are 12% more likely to be more profitable year over year.

5. Your Business is Growing Rapidly

Growth is exciting, but as your business scales, your finances become more complex. And if you don’t get any professional help even then, managing an increasing number of transactions, payroll, taxes, and expenses will quickly become overwhelming.

However, if you think you don’t need a bookkeeper yet, make sure you’re not experiencing any of the below-mentioned signs:

- You’re struggling to track cash flow as sales increase.

- The payroll system has become too complicated to handle alone.

- Vendor invoices and payments are piling up.

Four Key Benefits of Outsourcing Bookkeeping

You can make one of the smartest financial decisions for your decision by using outsourced bookkeeping services. Instead of spending valuable hours tracking transactions, reconciling accounts, and handling taxes, business owners can focus on growth while professionals manage their books. The significant benefits include:

1. Saves Time and Increases Productivity

Managing bookkeeping in-house can be time-consuming, especially for business owners who are already handling multiple responsibilities. Some time-consuming tasks for business owners include:

- Entering financial transactions manually.

- Reconciling bank statements and fixing errors.

- Preparing invoices and tracking payments.

- Managing payroll and calculating taxes.

Outsourcing frees you from tedious tasks and allows you to focus on the most crucial task—running your business. For instance, a restaurant owner can prioritize perfecting the menu instead of updating the books.

2. Reduces Errors and Ensures Compliance

Bookkeeping mistakes can be costly, which could lead to financial discrepancies, tax penalties, or even IRS tax audits. These mistakes include:

- Incorrectly categorizing transactions.

- Overlooking tax deductions and credits.

- Failing to reconcile bank statements.

- Payroll miscalculations leading to penalties.

You can eliminate these bookkeeping mistakes by simply outsourcing your bookkeeping at an affordable price.

3. Provides Better Financial Decision-Making

Another benefit of outsourcing your business bookkeeping is that it provides better financial decision-making. Without accurate financial data, businesses struggle to make informed decisions about growth, hiring, and investments.

Here are some signs that you have poor financial visibility:

- Not knowing how much profit the business is actually making.

- Uncertainty about whether to hire new employees or expand operations.

- Difficulty securing loans or investments due to unclear financial statements.

When you outsource bookkeeping, it ensures access to detailed financial reports and allows businesses to make smarter, data-driven decisions.

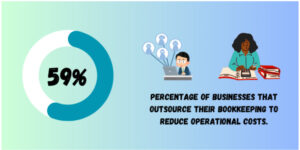

4. Cost-Effective Solution for Small Businesses

Hiring an in-house bookkeeper or accountant can be expensive, especially for small businesses that don’t have a large accounting budget. Studies show that 59% of businesses outsource their bookkeeping to reduce operational costs while maintaining quality financial management.

Here’s a cost comparison between an in-house and outsourced bookkeeper to make you understand why the latter is better.

- In-House Bookkeeper: Salaries range from $45,000–$70,000 per year, plus benefits and overhead costs.

- Outsourced Bookkeeper: Services start as low as $400–$1,500 per month, depending on the complexity of the business.

Outsource Your Bookkeeping to SmoothBooks

Instead of spending countless hours updating books, businesses that outsource bookkeeping save more time and gain accuracy as well as financial clarity. So, if you’re ready to outsource your bookkeeping tasks, we’re here to help.

At SmoothBooks, we provide affordable bookkeeping services that free up your time while ensuring your finances are in perfect order. At only $400/month, you can get accurate, up-to-date bookkeeping services to keep your business organized.

Get started today! Let SmoothBooks take care of your finances.