Launching a small business demands more than just time and money. It requires passion, dedication, and great ideas. But even with these, entrepreneurs often face challenges, and cash flow management can be a major roadblock. What exactly is cash flow, and why is it so critical?

Cash flow is the lifeblood of your business, determining your ability to pay bills, invest in growth, and ultimately survive. Let’s discuss cash flow in detail, its importance for a business, and tips on managing cash flow for small businesses.

Understanding Cash Flow

Cash flow refers to the net amount of money coming in and going out of your business over a specific time period. It combines cash inflows (money coming from sales, investments, and financing) and cash outflows (expenses like rent, salaries, and inventory).

Think of your cash flow statement as a bridge between your income statement and balance sheet. The income statement shows your profit, while the balance sheet shows your assets and liabilities. The cash flow statement shows how money moves in and out of your business and how you end up with the cash balance you have.

Positive cash flow means that more money is coming in than going out. Negative cash flow is the opposite and can be a warning sign of potential financial issues.

Difference Between Cashflow and Profit

Cash flow and profit are often confused with each other, but they are two distinct terms. Cash flow tracks the circulation of money in and out of your business, while profit is whatever is left after the expenses are paid. Profit shows your immediate financial success, but cash flow is crucial for long-term sustainability.

Importance of Cash Flow for Small Businesses

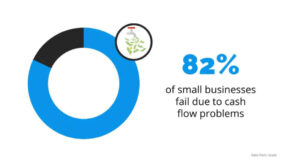

Cash flow for small businesses is more than just a number on a spreadsheet. It is a key indicator of your business’s health and financial stability. Unlike larger businesses with reserve funds, small businesses rely heavily on predictable income to meet their financial commitments. Research shows 82% of small businesses fail due to cash flow problems.

For instance, imagine a small software firm who completes several projects (showing profit), but clients are slow to pay. They might struggle to cover rent for their workspace or pay for essential software subscriptions. This can impact their ability to continue working.

A good cash flow helps owners understand the exact amount of funds available at any given moment. It enables realistic business plans and prevents personal funds from being used to cover business expenses.

Common Cash Flow Challenges for Small Businesses

Cash flow management problems can quickly escalate into major crises for a small venture. Before managing cash flow for small businesses, let’s take a look at some of the most common cash flow challenges:

Slow or Delayed Payments from Clients

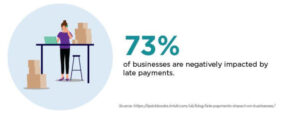

Slow or irregular payments are one of the key cash flow problems for small businesses. With tight budgets, small businesses rely on regular client payments to pay expenses and expand. It is very common for clients to delay payments. This can create serious financial challenges for your business.

Stats show that 73% of businesses are negatively impacted by late invoices, and 40% risk closure within a year if the issue persists. To avoid this, set up clear payment terms in the beginning.

Lack of Proper Bookkeeping

34% of owners handle their own small business bookkeeping, which involves a lot of tasks. From tracking transactions, managing expenses, and keeping the books balanced, it is easy to miss things or make mistakes. Poor bookkeeping can lead to unexpected financial losses, compliance issues, bad decisions based on inaccurate data, and a lack of clear financial visibility.

Without accurate records and financial reporting, it’s also hard to see where your money is going, which makes it tough to make smart business decisions.

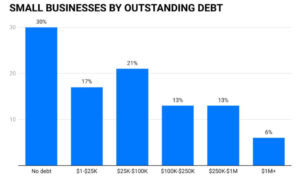

Excessive Debt Payments

Starting a small business often requires a loan, which can be helpful for initial costs, working capital, and investments. However, too much debt can cripple the cash flow, and high interest rates create extra financial strain. Almost 21% of businesses are dealing with an outstanding balance between ($25k to $ 100K) while 30% have none at all.

Always keep your monthly loan payments as a top priority. Remember, if your debt exceeds 30% of your business capital, it’s a warning sign to reassess your finances.

No Reserve Funds

Unexpected costs pop up in every business, no matter how successful it is. A reserve fund is like an insurance policy for your business. Its money is set aside specifically for those rainy days: a broken piece of equipment, a sudden drop in sales, or an unexpected legal bill.

Having a reserve gives you breathing room and prevents surprises from derailing your entire operation. It also allows you to seize growth opportunities, such as investing in new equipment or expanding into a new market.

Managing Cash Flow for Small Businesses: Best Tips and Techniques

Maintaining a healthy cash flow requires more than just consistent revenue. Here are some essential tips and best practices for managing cash flow for small businesses:

Predict Your Cash Flow

The first step in cash flow management is forecasting. Predict how much cash will come in and go out of your business over the next month, quarter, and year. Start by collecting financial data, such as previous sales and expenses. Analyze your sales trends, consider seasonal fluctuations, how quickly customers typically pay, and any changes in the market.

For instance, if you own a clothing store, you might predict higher sales (and higher cash flow) during the holiday and festive season. The better your inputs, the more accurate your predictions will be.

Hire Professional Bookkeeping Services

There is no doubt that every business needs a bookkeeper in 2025. Professional bookkeeping experts can organize all of your transactional records, prepare financial statements, and ensure everything is accurate and up-to-date. Having organized records at your fingertips makes budgeting, cash flow analysis, and general finance planning much easier.

Bookkeepers also play a key role in cash flow management. They can help clean up messy records, keep your books updated, and even create accurate cash flow predictions. Knowing when money is coming in and going out is essential for paying bills and making smart investments. Also, it can help you identify areas where you can cut costs and improve your bottom line.

Keep Your Business and Personal Funds Separate

Don’t underestimate the importance of separating your personal and business finances. Mixing funds can mean missing out on valuable tax exemptions.

Businesses are eligible for various tax deductions that individuals aren’t. Additionally, if your business runs into financial trouble, keeping your personal finances separate can protect your personal assets and credit score.

Beyond tax benefits and liabilities, separating finances simplify accounting and tax filing. Keeping business funds separate makes it much easier to track your business health and file accurate tax returns.

Use Dedicated Software

If you are still using manual methods like spreadsheets or ledger books, managing cash flow will be incredibly difficult. This is where accounting and bookkeeping software comes in. These tools automate financial record keeping, track transactions, and simplify management.

Bookkeeping software also minimizes human errors and provides real-time financial updates. They can also generate essential reports like income statements, cash flow statements, and balance sheets. This gives you a clear and up-to-date view of your finances.

Schedule Your Payments and Invoicing

Getting paid on time is extremely important for a smooth cash flow. Invoicing plays a vital role in this. Send out the invoice as soon as you deliver a project or a service. Delayed invoicing can create cash flow problems. While the timing of invoices can vary (weekly, bi-weekly, monthly, or based on milestones), consistency is the key.

Let SmoothBooks Manage Cash Flow For Your Business

Managing cash flow for small businesses demands careful planning and smart initiatives. Accurate forecasting, separating personal and business finances, and timely invoicing are crucial steps. However, partnering with professional bookkeeping services can be a game changer. This brings expertise in financial management and helps you focus on your core business activities.

Looking for a reliable bookkeeping and accounting partner? Switch to SmoothBooks. Our experienced team handles everything from bookkeeping and data entry to taxation and financial reporting, ensuring your small business cash keeps flowing smoothly.